We do the analysis. You get the compounding.

Smart investing isn’t a miracle — It’s research.

About us

About PB Shruti

I’m PB Shruti, a SEBI-registered Research Analyst since 2021. Post my education in B.Tech and a PGDM in Banking & Financial Services, I’ve spent over six years working in finance. I have worked in corporate valuations prior to following my passion for simplifying investing for investors.

I have started this service with the intent to offer completely independent, regulation-backed research without any influence of commissions or brokerage ties. My research is backed by diligence, discipline, and a deep respect for your money.

I believe

- Patience is paramount in long term investing.

- Research should empower and not overwhelm

- Transparency and trust are non-negotiable

Why Choose Us?

SEBI-Registered Expertise

I oversee all research personally, ensuring every recommendation is backed by in-depth analysis as well as stringent compliance.

Full transparency and control

No Conflict of Interests

Clear, Structured Solutions

Choose the Perfect Plan for Your Financial Success

I provide research-based investment insights through structured newsletters, offering clear, actionable recommendations for both direct equity and mutual fund investors.

Flexi-cap Model Portfolio

- Only for long term investors

- Equity + liquid bees portfolio

- Stock selection across large, mid, and small caps

- Rebalancing Frequency- Monthly

Mutual Fund Picks

- Only for long term investors

- Our picks across all main mutual fund categories

- One-time download of our picks to begin your SIP journey

- Update Frequency- Annual

Any question about our offerings? You can contact us.

Investment Philosophy

Our philosophy revolves around three things: strong businesses, appropriate price & a long-term focus.

- Strong businesses are built on sound fundamentals, ethical leadership, and long-term growth potential.

- Appropriate price is determined using a techno-fundamental approach.

- Long term focus requires patience, consistency and prioritizing structured approach over emotions.

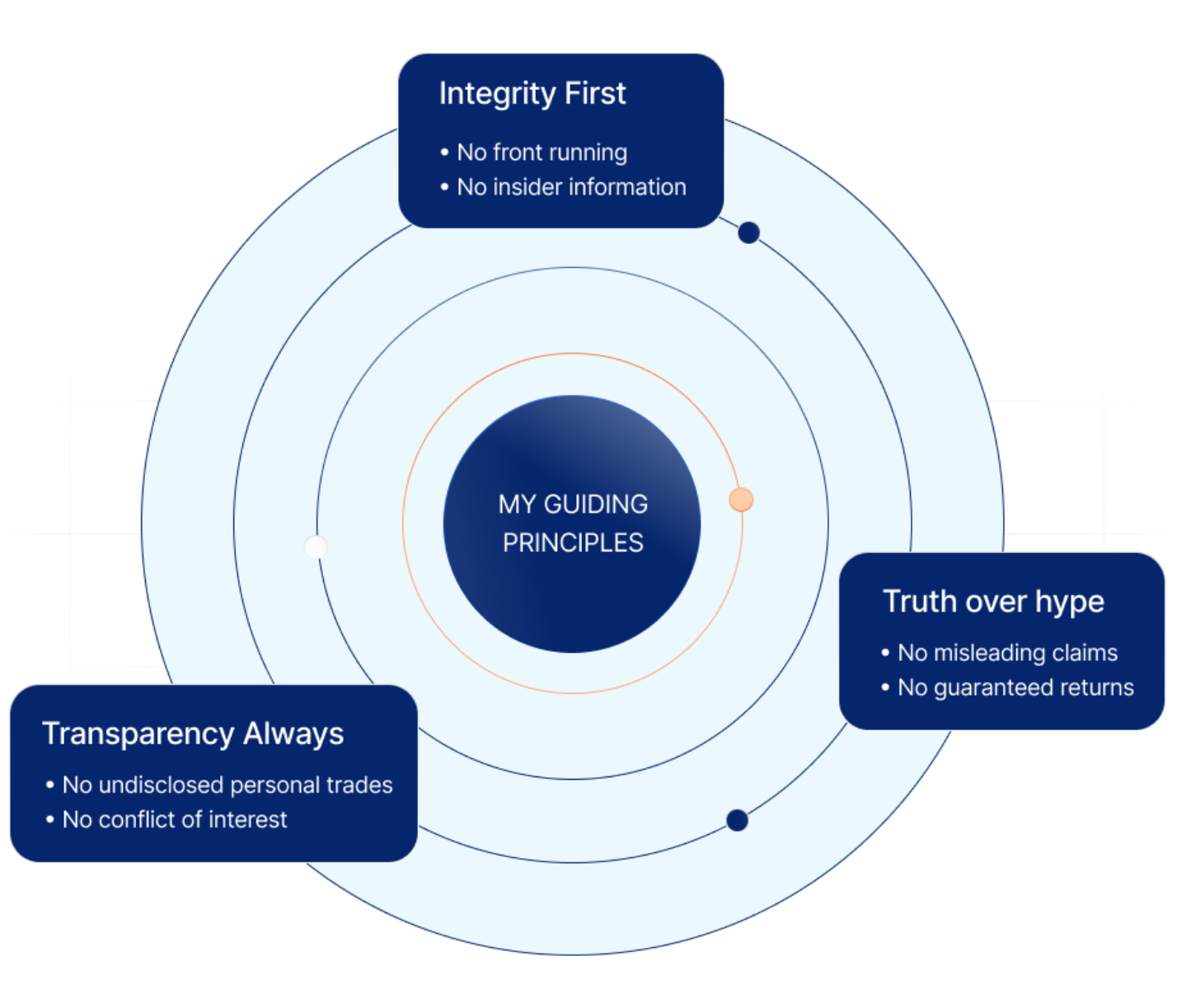

Ethics aren't an obligation they're the foundation.

What sets my work apart is an uncompromising commitment to doing things the right way, every single time. This is not just what the regulation requires, rather it’s who I am.

- My research is objective, fact-based, and driven by my independent opinion.

- I do not receive any brokerage or commissions.

- Any financial interest in securities covered is disclosed.

- I do not promise guaranteed profits, as all investments carry risks.

- I follow ‘30 days prior and 5 days after’ rule for any personal trading done in the stocks that I recommend.

- I strictly follow the rules around non-public material information.

Onboarding Process

I follow a structured onboarding process to comply with SEBI regulations and ensure a seamless experience for investors.

Steps to Subscribe

Express Interest:Visit www.pbshruti.com to choose a plan. I DO NOT PROVIDE SERVICES ON ANY OTHER PLATFORM

Accept Terms & Conditions using Aadhaar OTP based e-sign.

Make Payment using Valid UPI QR code received in e-mail.

Complete e-KYC Verification: Requires PAN number and Name as on PAN.

Reports are emailed after successful e-KYC. Subscription date starts only after e-KYC is verified. Customers are eligible for full refund in case of a failed KYC.

Renewal link will be sent to your registered email.

Unsubscribe Anytime without any no lock-in period for subscription services. Re-onboarding is needed if renewal lapses or you opt out.

To pay, select the intermediary’s Valid UPI ID in your UPI app, check the collect request or mandate, and approve it. Valid UPI IDs are issued only by banks to SEBI-registered intermediaries and are linked to verified accounts, which helps protect you from fraud. When you scan a QR code, look for the white thumbs-up icon with green background— that indicates the UPI handle is validated. You can also use SEBI Check by entering the UPI ID or scanning the QR code; it shows the name and bank of the intermediary so you can confirm you’re paying the right entity. Always pay only to the verified handle and save your transaction reference.

Frequently Asked Questions (FAQS)

FAQ

The model portfolio is a curated set of long-term stock recommendations for investors with investment amount of ₹2,00,000 or more. It is rebalanced monthly and suits those who invest via demat accounts. Mutual fund picks offer simpler, diversified options for investors with smaller amounts.

Express Interest: Visit pbshruti.com and choose your subscription plan.

Accept Terms & Conditions: Complete Aadhaar OTP e-signing.

Make Payment: Secure payment via UPI QR.

Complete e-KYC: Submit KYC Documents (as requested) for verification.

Receive Reports: Receive reports via email once KYC is verified.

The model portfolio is rebalanced monthly. Reports include stock weightage changes, additions or deletions, and tactical cash shifts (using liquid bees) based on market conditions.

We recommend a minimum of ₹2,00,000 for the model portfolio. Below this, the cost relative to investment size may be too high. For lower capital, consider our mutual fund picks, which may be more economical.

Most mutual funds allow investments starting from ₹500 to ₹1,000. They are generally well-diversified investments even for smaller capital.

KYC is mandatory under SEBI guidelines. If your KYC fails, we request you to complete it via CAMS, your bank, or your broker. If you’re not comfortable with these options, we offer a full refund, as we cannot provide services without valid KYC.

Due to regulatory restrictions, we are unable to publicly disclose past performance until SEBI-appointed PaRRVA (Past Risk and Return Verification Agency) commences verification of our performance claims.

Yes, you’re free to modify the portfolio. However, we don’t offer customization or execution services. The model portfolio is designed for optimal diversification, and performance is tracked at the portfolio level. Modifying recommendations may affect alignment with our strategy and could lead to outcomes that differ from intended results.

Rebalancing updates ensure your portfolio stays aligned with market shifts and new insights. Monthly updates are provided, but the subscription is billed annually. This service is available only to existing clients.

This is ideal for investors with a high-risk appetite, a minimum investment of ₹2,00,000, and a 5+ year investment horizon. It is designed for long-term equity investors.

Currently, we do not offer automated execution services via broker API integration. We provide recommendations via PDF to your registered email. We are working on this feature and will update clients once available.

We do not offer trading tips. Our focus is on long-term investments through model portfolios or mutual fund recommendations, aiming for value growth over time.

No, we do not offer free trials for our services.

Mutual fund picks are updated annually to ensure they reflect current market conditions and offer the best options for diversified investing.

Our model portfolios are long-term focused. However, we request you to exercise caution when implementing a recommendation at a price significantly different from when the stock was originally added. To ensure alignment with our research and market conditions, we recommend following the rebalancing updates for optimal returns.

One-time purchases like the model portfolio and mutual fund picks are non-refundable. However, the rebalancing report subscription is eligible for a proportionate refund for the unused period. In case of failed KYC, a full refund is provided—regardless of the product chosen.

The investors can choose their preferred mode of payment, such as UPI, IMPS, NEFT, RTGS, or Cheques. If an investor opts to use UPI for the payment to registered intermediaries, then they have to do so only using the new UPI IDs allotted to registered intermediaries.

Investors need to keep following things into consideration:

1. The UPI ID should properly show the name of the intermediary, followed by the short abbreviation of their category for example “brk” for Brokers, “mf” for Mutual Funds to the left of the “@” character.

2. On the right side of the “@”, the new and exclusive handle “@valid” should be present, followed by the bank name.

3. On the confirmation screen, the app should show a white thumbs-up icon inside a green triangle.

4. The QR code generated using the utility will have a white thumbs-up icon inside a green triangle. It will also display the UPI ID just below the QR code.

No, the new UPI IDs are only for intermediaries to obtain and investors can continue to use their existing UPI IDs.

The secure validated UPI ID of intermediaries will use the same banking channel as the earlier generic UPI handles. In case of any technical difficulty, investors are requested to approach their respective bank.

Know More About Our Offerings

By combining rigorous research with a disciplined investment approach, I aim to empower investors to make informed and confident financial decisions.